First Quarterly Business Review of the Year

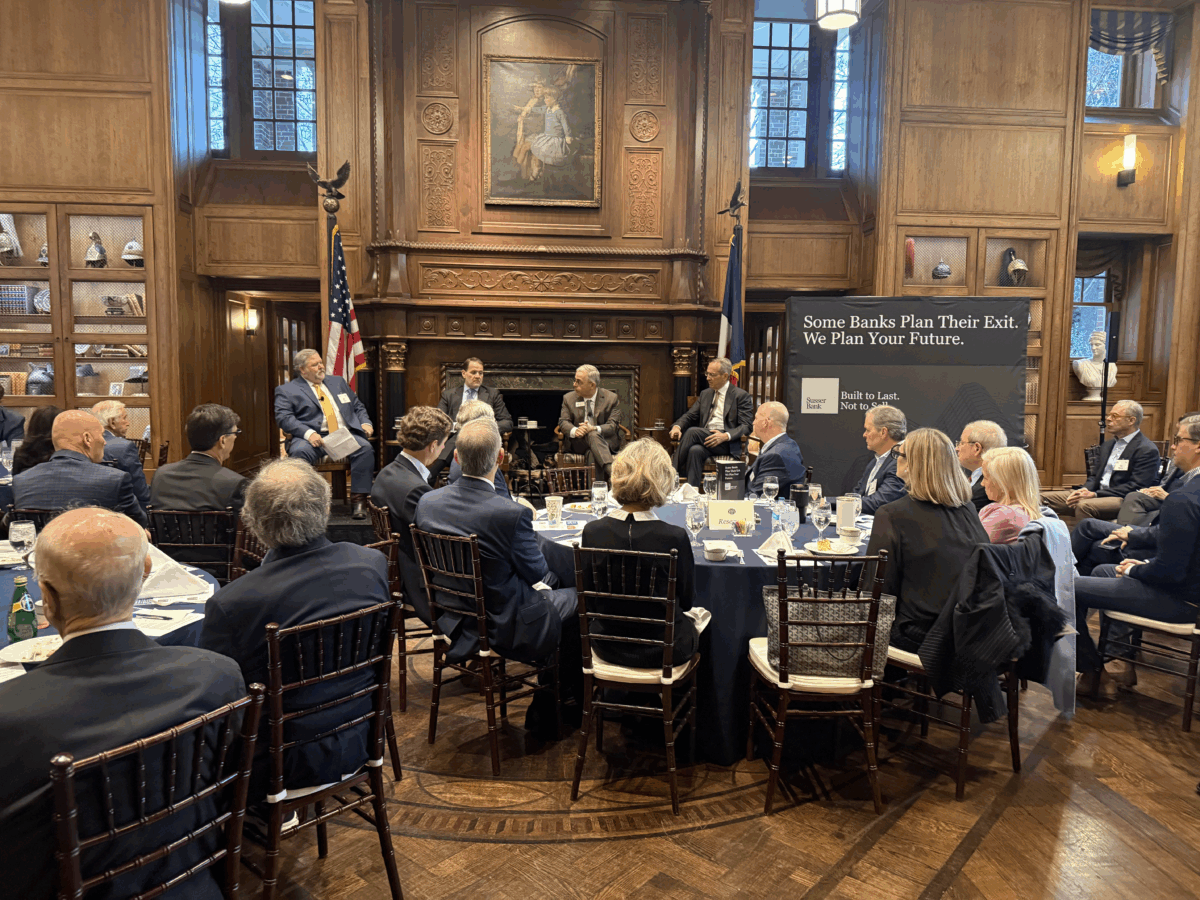

Our first Quarterly Business Review of the year brought leaders from across all our markets together around a simple but powerful theme: Execution. Because as Carl Cravens, President and Chief Banking Officer, put it, the mountain doesn’t reward climbers with great potential…it rewards execution.

Day one grounded us in the fundamentals. As we reflected on 2025, we also looked ahead, discussing how disciplined growth, thoughtful strategy and deep client relationships will continue to define our path forward. We were grateful to learn from Dan Hajdu, Director, Derivatives Products Group, PNC, and Chelsea Rheam, Senior Associate, Derivatives Products Group, PNC, who led a productive discussion on interest rates and swaps in an evolving market environment.

Day two pushed us into what’s next. Alex Treece, Co-Founder & CEO of Stablecore, and Jessi Goostree, Executive Director of the Texas Blockchain Council, sparked a dynamic conversation on digital assets, stablecoin and the implications for financial institutions committed to learning and navigating a new world of payments, currency and business models that will impact all businesses.

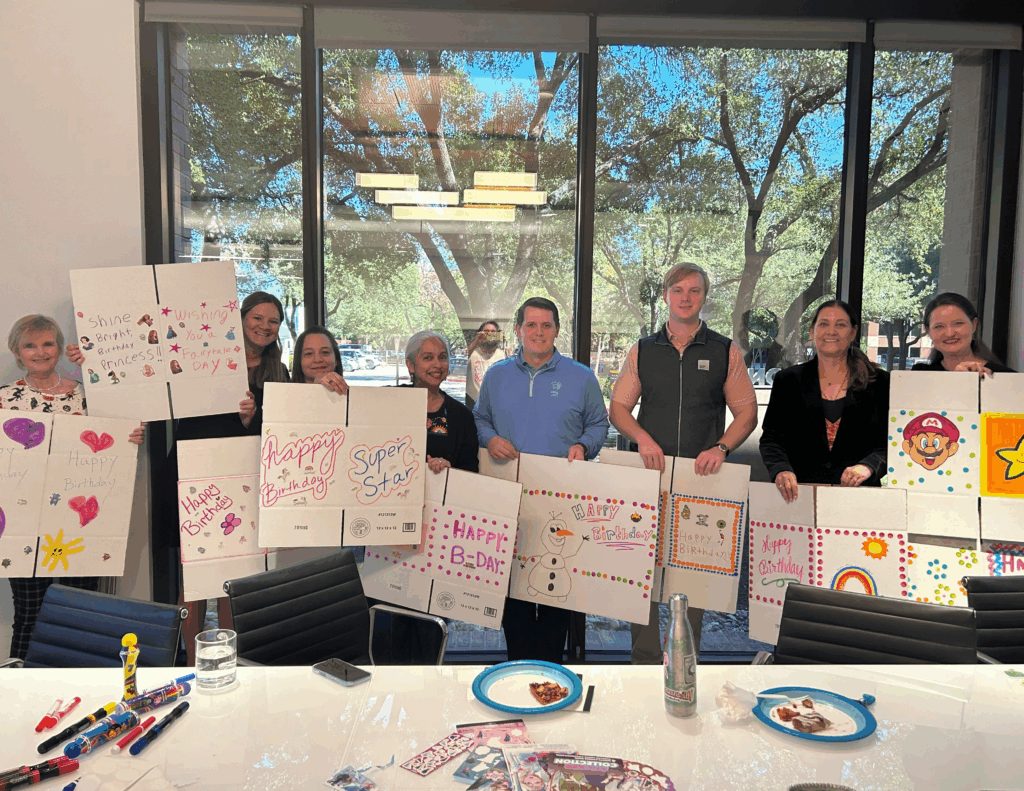

We also took time to recognize excellence within our own team. Congratulations to Tim Caperton, MBA, Senior Vice President, Senior Relationship Manager for our Austin market, who was recognized for his outstanding performance to date. His leadership and commitment to our clients exemplify the standard we strive for across the bank.

And because strong teams are built both in and out of the boardroom, we capped it off with an evening at Andretti Indoor Karting & Games, a little friendly competition, a lot of laughs and a great reminder that connection fuels performance.

Grateful for the thoughtful dialogue, the energy and the shared commitment to building a bank that continues to innovate, adapt and deliver for our clients, setting the tone for 2026 and beyond.